Work out stop loss position.

Work out entry position.

Work out profit level. (Read How to read a Signal if necessary here:

https://cryptogb.com/f/threads/how-to-read-a-signal.5/ )

Go to Trading View or similar website. (create a free account - if you don't have one)

https://www.tradingview.com/gopro/

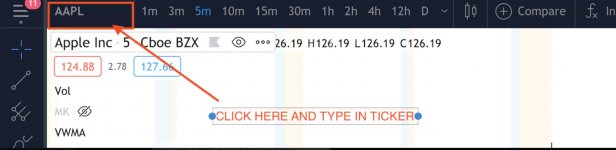

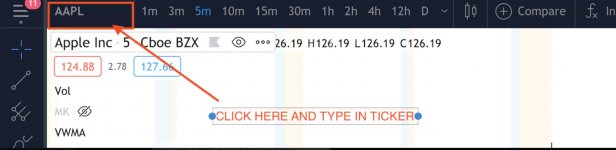

Head to the ticker you plan to trade: eg. BTCUSDT

Select the short position or long position tool.

Place the tool on the chart and drag and drop -The entry (where the green and red meet)

-The red stop section (where your invalidation point is)

-The green take profit section (to where your take profit will be)

Take note of both; -Percentage to stop loss, 2.33% -Entry price, 45134.91 Optionally the profit percentage, (6.03%)

Travel to

https://profitd.io/risk-calculator and enter the numbers like the image below.

Convert the position size / leverage (if applicable) to your trading platform and enter. This may take 5-10 minutes your first few times but over time this now takes me around 5-15 seconds to calculate.

You are now trading profitably. Not yoloing. This is how the pros trade.

Overtime they will increase account risk as required.

But they have tested strategy and win rates. So don't be a hero, don't over-risk,

If you want to over-risk all good. But accept your wins and losses.

Ive never seen a pro trader risk more than 5% on a 80% win rate strategy. (so start small)

LEVERAGE IS NOT TO INCREASE PROFITS OR LOSSES IF USED CORRECTLY!

Its to free up capital!